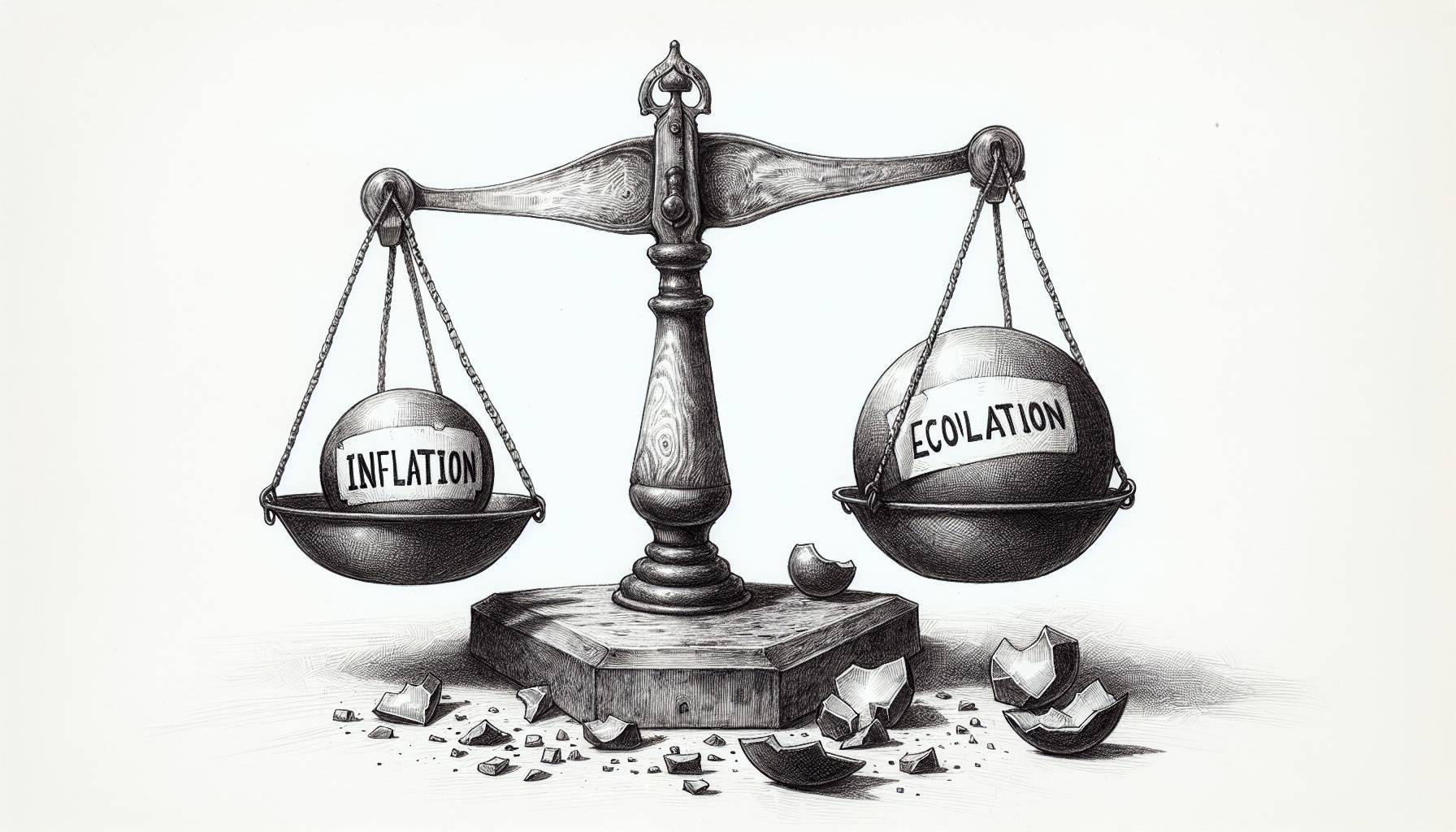

The Federal Reserve is preparing to announce its third interest rate decision for 2024, much to the anticipation of national and international markets. This decision, necessitated by the consistent inflation and associated rise in living costs, is expected to have a major bearing on both investor confidence and market stability. Economists and analysts are cautiously revising their previously optimistic forecasts due to the continuous inflation which denotes a weakened purchasing power.

Somewhere between September to November, financial analysis firm FactSet foresees an interest rate cut. Yet, the inflation’s ongoing impact on interest rates possibly hints at extended periods of increased borrowing costs for consumers. FactSet’s predictions, however, aren’t unchangeable and unexpected shifts in the economy could alter the outlook. Hence, with the prospect of prolonged inflated borrowing costs, consumers are advised to plan their finances wisely.

Senior economist at LendingTree, Jacob Channel, cautions about the risk of further inflating the situation if the rates are cut prematurely, thereby causing difficulties for individuals and businesses alike. He underscores the Federal Reserve’s formidable task of controlling inflation and speculates that the organization may retain higher rates until inflation is brought down to manageable levels.

Expected to discuss the impending rate and economic outlook, Fed Chair, Jerome Powell, will hold a press conference on Wednesday.

Federal Reserve’s influence on market stability

Analysts widely believe that the Fed will keep its benchmark rate at 5.25% to 5.5%. The main point under discussion will be the need for the economy to keep up with the convalescence from the pandemic, with the hope that the Fed’s decision will continue to propel the ongoing economic recovery.

Despite the Fed’s continuity in efforts, rising housing and gasoline costs leading to increased consumer prices have countered its pursuit for stabilization. Wall Street traders, as a result, are leaning towards a single rate reduction for the year instead of multiple cuts. The underlying concern, however, remains that neglecting periodic financial tweaks could lead to increased financial instability. Therefore, proper evaluation and execution of the rate reduction remain critical to manage ballooning consumer prices effectively.

Speculations suggest the next rate cut by Fed may happen either during the September 18 or November 7 meeting, with cuts only being a quarter of a percentage point each. For consumers, this could mean high borrowing costs for things like mortgage and credit card rates due to the prevailing inflation trends. However, these cuts are intended to stimulate economic growth by making money borrowing less costly, providing a potential long-term reprieve for borrowers.

In closing, banking specialist Ken Tumin offers encouragement to savers who can benefit from high-interest savings accounts with yields over 5%. He notes that, even amid a volatile financial landscape, there are reliable investment tools capable of providing modest returns and featuring relatively low risk.