Tyler Loudon, a Texas man of 42, admitted to engaging in insider trading, reaping $1.76 million in illegal profits by prying into his spouse’s professional discussions. Despite initially denying his involvement, Loudon eventually confessed.

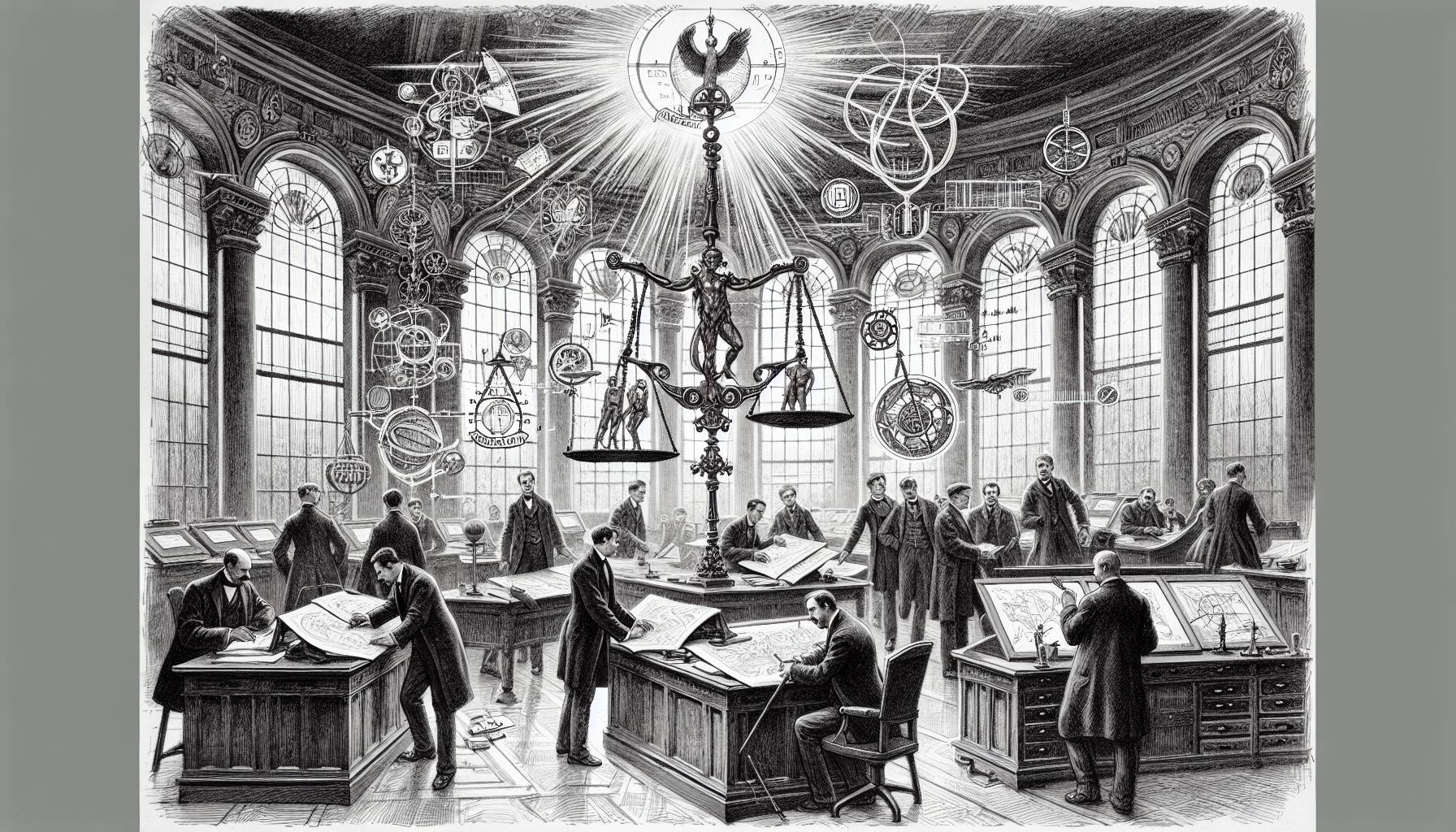

The Securities and Exchange Commission stated that Loudon leveraged information overheard from his wife, an executive in a significant pharmaceutical firm, to conduct informed stock trades. This revelation led to his arrest and prosecution, where he faced grave charges for breaching securities law.

If convicted, he could face a hefty prison sentence and substantial financial penalties. The court case sparked further debates about the ethical implications of insider trading and highlighted corporate malpractice.

Authorities, with this case, aim to tighten regulation of the stock market and penalize anyone who exploits it for personal gain. Loudon’s case serves as a warning to others who attempt to manipulate the market via insider information.

The outcome promises to set a noteworthy precedent for future insider trading cases. Meanwhile, Loudon’s tale acts as a stark warning that illicit profits cannot eclipse justice.

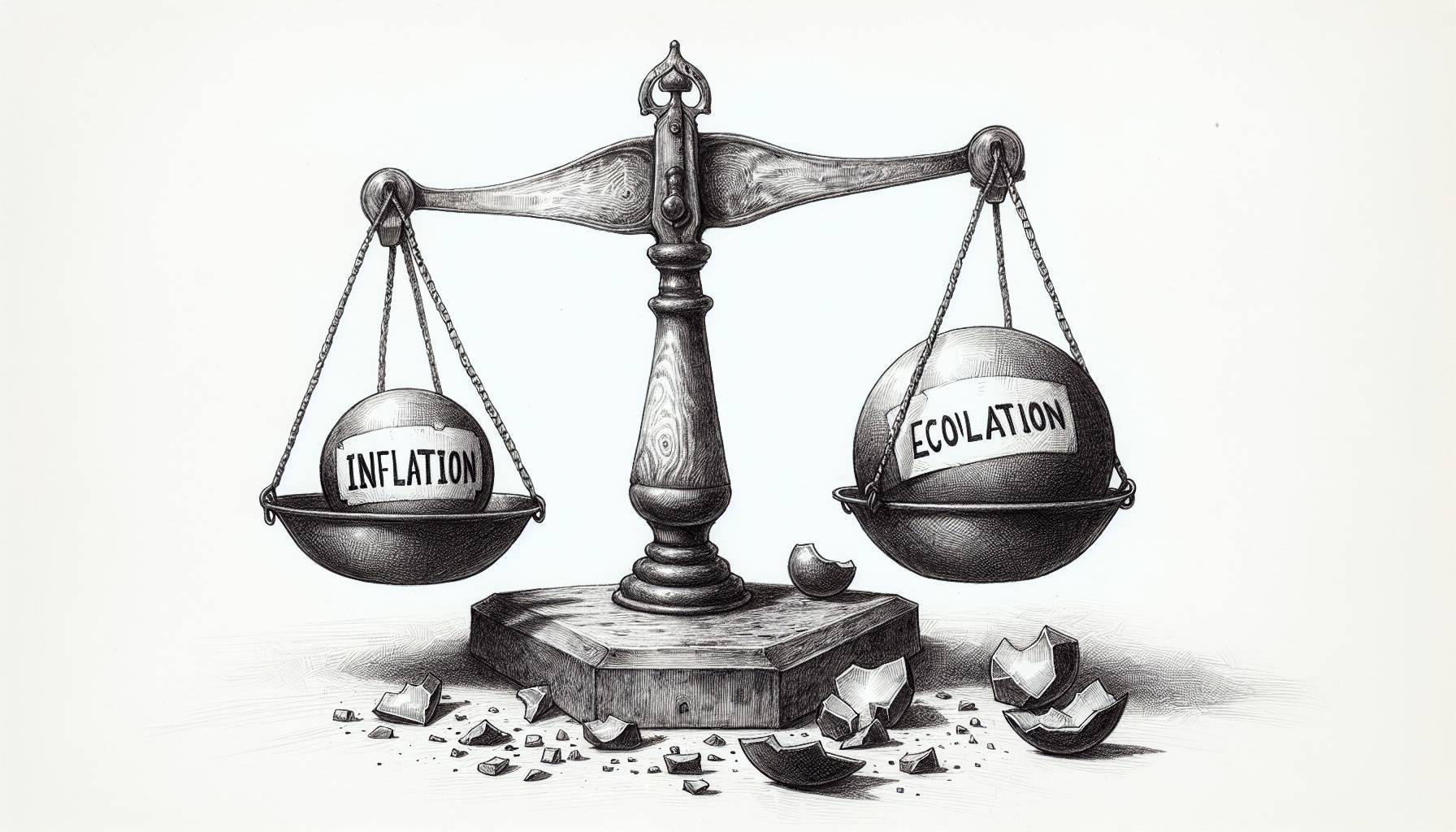

Loudon discovered through his spouse, a high-profile official at a renowned oil and gas corporation, of the upcoming acquisition of TravelCenters of America, worth $1.3 billion, scheduled for February 2023. Shrouded in fear and uncertainty, Loudon kept this significant financial news to himself.

He subsequently made a private purchase of 46,450 shares of TravelCenters stock. Following the acquisition’s public declaration, stock prices soared by around 71%, resulting in significant profits for Loudon upon selling his shares.

However, his illicit activities were exposed, leading to charges of insider trading, his immediate downfall, and hefty monetary penalties. The incident served as a stern warning for investors about the importance of ethical conduct in business operations.

Amid allegations of exploiting privileged information, authorities charged Loudon with insider trading. Consequently sparking a dispute with his wife and unraveling trust issues. Overwhelmed with guilt, Loudon relinquished his shares and confessed his activities to the authorities.

The verdict has not only harmed his personal reputation but disrupted the stock market’s integrity. Despite the turmoil and ongoing legal battles, his wife has extended her support and the hope for light at the end of the tunnel.

Loudon, facing the intense repercussions of his actions and ostracization from friends, sought professional help. However, his wife, overwhelmed by the incident and facing public scrutiny, moved on and started rebuilding her life and career.

Despite confessing and agreeing to a partial judgment awaiting court approval, the incident serves as a harsh lesson underscoring the serious implications of insider trading. Loudon’s professional reputation will likely be irrevocably tarnished, and he may face hurdles in re-establishing trust in the market.

The incident illustrates the importance of ethical business practices and legal commitment to fairness in financial activities. With further developments expected in the Loudon case, it will undoubtedly serve as a key example for future instances concerning financial regulations and ethics.