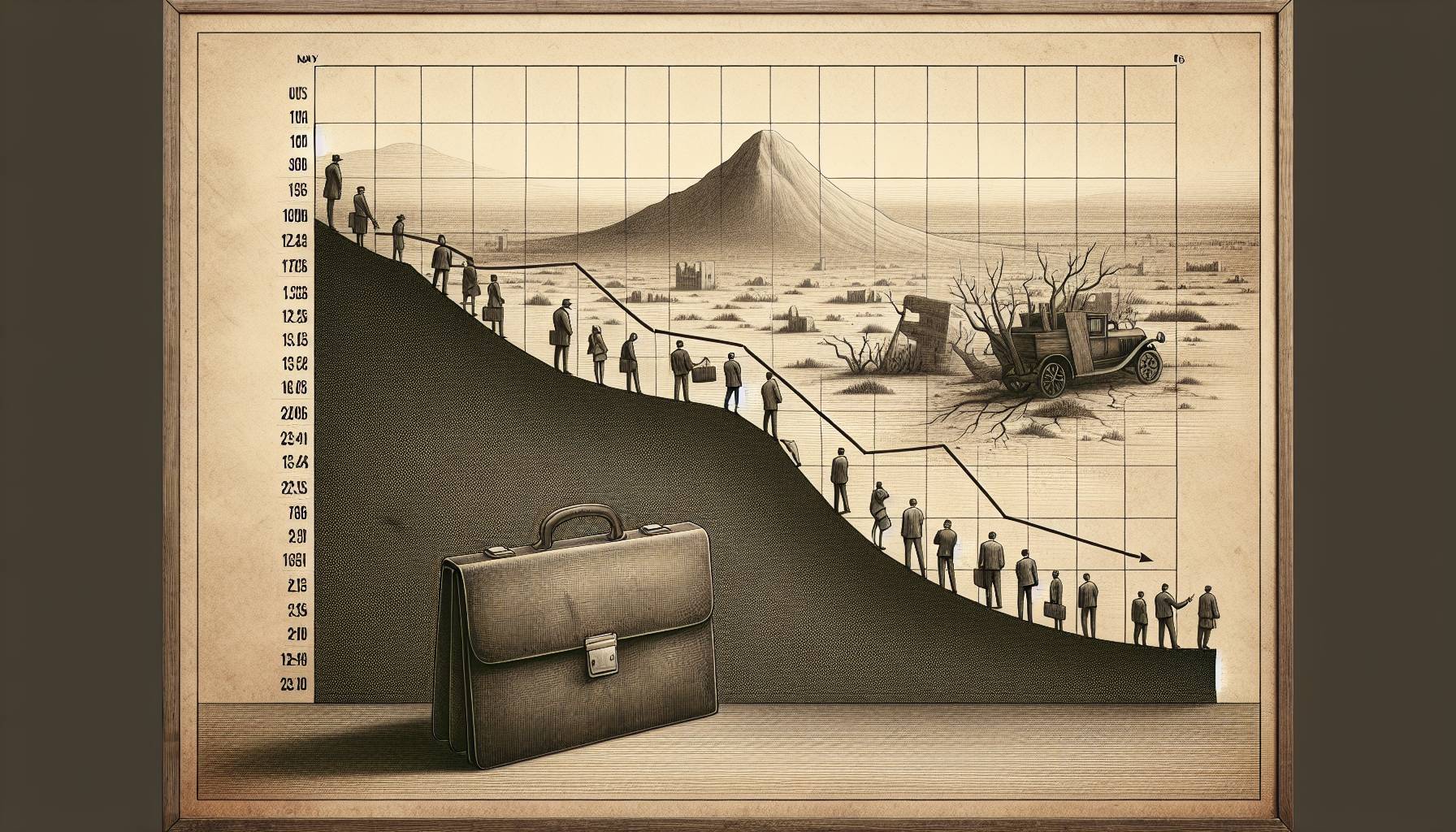

The U.S. Social Security program, a primary social insurance plan for the elderly, is facing growing concerns due to an escalating discrepancy between projected benefits and impending tax income. This will affect both government and private sector retirement schemes. The trustees of Social Security have confirmed these concerns.

Reports predict that the reserves are anticipated to be depleted by 2034, creating a sense of urgency to address the issue. An ageing population is leading to fewer individuals in the workforce, unable to support the increasing number of retirees. Lawmakers have been urged by trustees to address this issue promptly to prevent severe cuts to future benefits.

The viability of the Social Security program is further complicated by a slower growth in contributing workers compared to beneficiaries. The ratio of workers to beneficiaries has been steadily decreasing, currently at 2.8 compared to 5.1 in 1960. This decline is expected to persist, leading to concerns about the program’s long-term solvency.

If no action is taken, it is forecasted that the Social Security fund reserves could be depleted by 2034, with only about 79% of the promised benefits to retirees being provided through ongoing tax income. National and state-level policymakers must consider these forecasts to look into potential solutions to protect the program’s financial future.

The Financial Report of the US Government, released in February 2024, exposed an underfunding crisis of nearly $175 trillion, whereby financial obligations considerably outweigh the capability of taxpayers to contribute.

Addressing the impending social security shortfall

This strain also applies to other pension schemes, which are based on certain economic expectations about their future obligations.

Measures need to be taken swiftly and strategically to address this risk. Possibilities include increasing tax rates, reducing benefits, or realigning economic assumptions about these pension schemes. The vast funding gap is escalating concerns over the availability of resources to fund other critical governmental sectors, such as education and healthcare, possibly hindering national developmental goals.

Therefore, ensuring these pension schemes’ fiscal sustainability is not just critical for the recipients but also a societal priority. Policymakers must take the utmost care, encourage innovative thought, and commit to securing the contributors’ future to society. The complexity of these choices echoes their potential impact, emphasizing the need for informed, responsible decisions.

Retirement plans typically assume a 7% average annual return on investments, which diverges with actual compound returns. This can create a deficit if investment returns are inadequate, or if system demands increase. Both Social Security and Medicare must address this intricate financial and demographic challenge.

Several potential solutions proposed include raising the retirement age, encouraging private savings or increasing taxes. The acceptance and implementation of these measures could have a considerable societal impact. Therefore, it requires a comprehensive, long-term strategy to address the situation, as the decisions made today will exist in policies and practices for decades, affecting future retirees’ ability to support themselves during retirement.