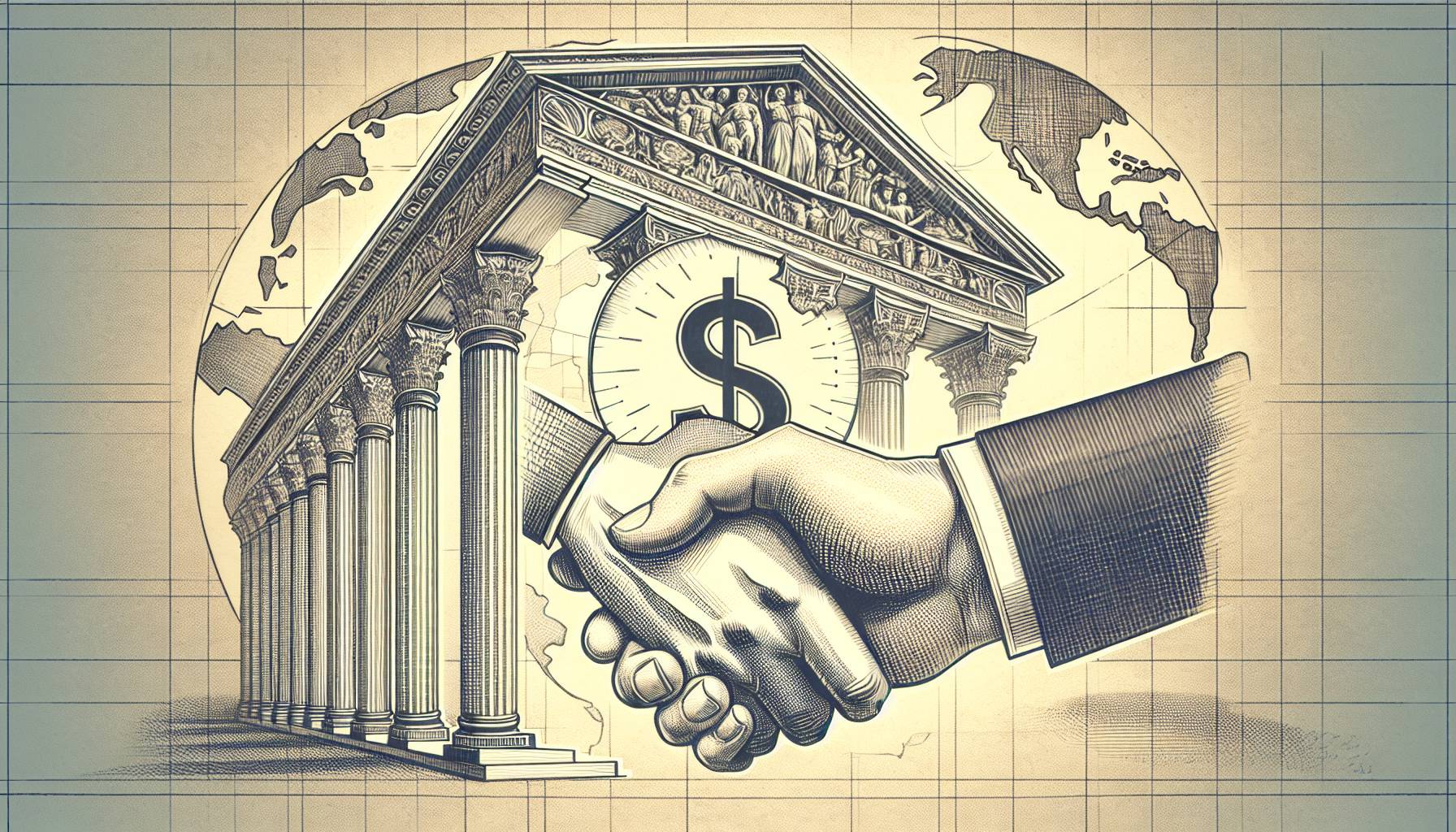

South Korea, despite its unstable history with foreign exchange, has been diligently working to gain solid ground in the global financial landscape. Its focus was brought into sharp relief on March 25, 2024, as it highlighted the country’s determination to transcend the unpredictable and volatile foreign exchange scene.

South Korea is keen on deepening financial cooperation with foreign countries and enhancing global financial safety nets, all while bolstering its domestic economy and rejuvenating its financial institutions. These resolve and reforms demonstrate its commitment to becoming a significant player on the global stage.

The path for the South Korean won to acquire global acceptance has been riddled with challenges. Yet, the country’s consistent economic growth and development have added momentum. Its adoption of more transparent monetary policies, along with remarkable market reforms, has substantially bolstered the credibility of the South Korean won. Even so, establishing the won on an international scale requires more extensive cooperation with global financial institutions and a liberalized foreign exchange market.

South Korea’s increasing global financial influence

Some argue that despite the hindrances, the Korean won has made a more significant global impact than the British pound. They contend that the won’s surprising influence on the international stage demonstrates South Korea’s burgeoning economic strength. This unexpected rise can’t simply be overlooked, even in comparison to the longstanding weight of the British pound.

Among concerns from various Asian economies, a compliance official from China soothes concerns about a decline in Foreign Direct Investment (FDI) in the world’s second-largest economy. They state that current market variations are “normal” and assure measures are being taken by the Chinese government to stabilize the market and reel in more FDIs.

Changes are also evident in the fiscal landscape of Japan. The Bank of Japan appears to be shifting from a conservative stance to a data-dependent policy decision model. This shift signifies a departure from tradition and suggests the Bank’s determination to stay abreast with the ever-changing global economic situation.

This report was skillfully formulated by journalists, Jihoon Lee, based in Seoul, and Rae Wee, from Singapore. Final touches to the script were expertly made by Sam Holmes.