On March 13, 2024, Wall Street experienced mostly a downward trend. The cause can be traced back to profit-taking in the chipmaker industry and potential volatility due to anticipated inflation figures and a forthcoming Federal Reserve meeting.

Minor declines were seen in the S&P 500 and Nasdaq, while the Dow had a slight increase of 0.1%. Market uncertainty particularly affected sectors with robust international trade ties, as the crisis in Eastern Europe continues to evolve.

Technology stocks, especially those from the chipmaking industry, faced the brunt of the sell-off. Major companies like Intel and AMD ended the day with substantial losses. Wall Street analysts are closely observing these trends, which might indicate future economic developments.

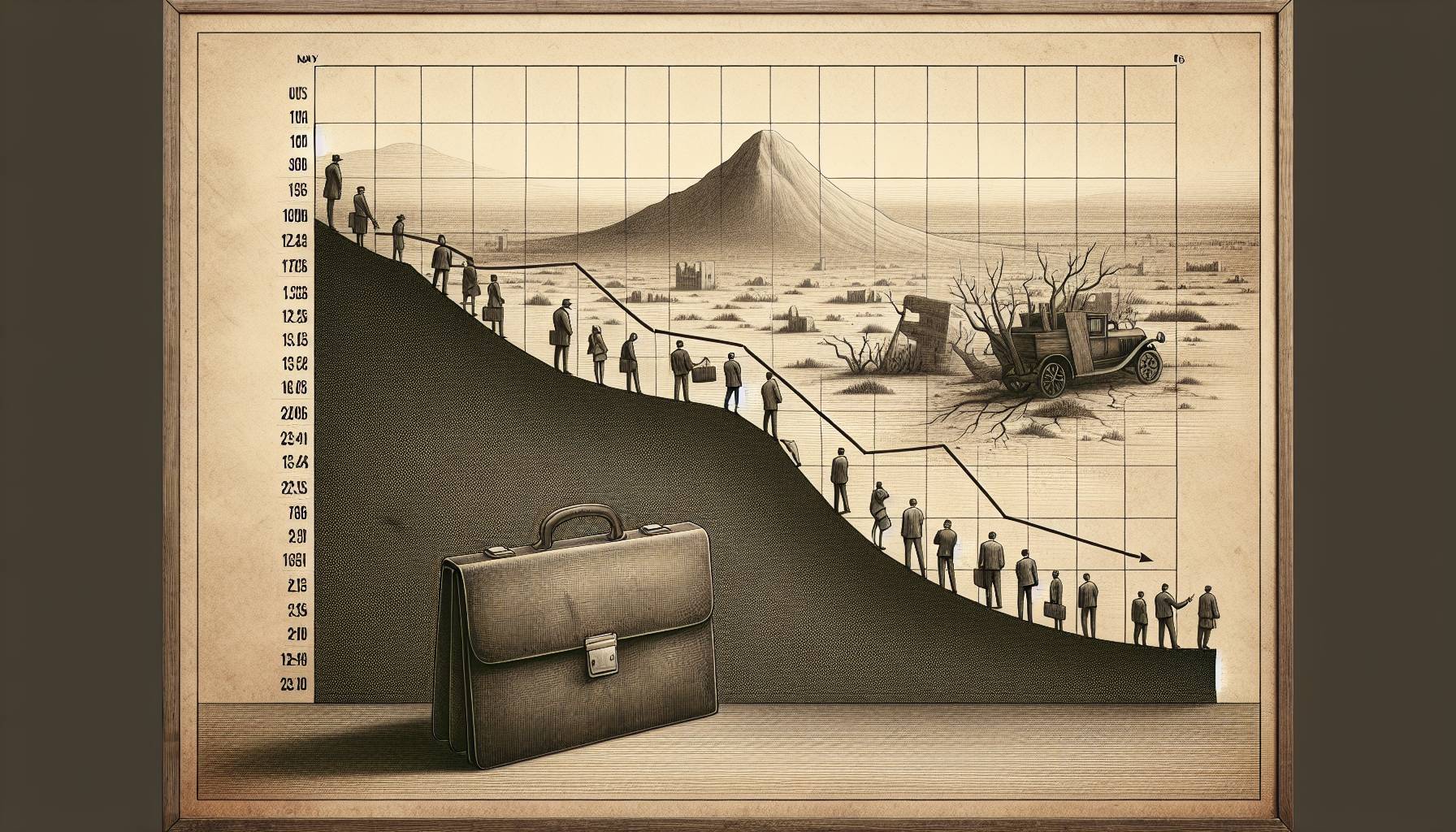

A significant trigger to the market dynamics was Dollar Tree’s announcement to close nearly 1,000 of their stores. This decision led to a decline in their share price and a considerable decrease in their market capitalization. Dollar Tree’s decision had an impact on the retail world, causing a ripple effect across the sector.

Increased competition was a byproduct of this situation, as competitors seized the opportunity to bolster their market share. Concerns about potential job losses arose due to Dollar Tree’s store closures, indicating broader social and economic impact.

However, commercial real estate investors saw opportunities from available properties. These shifts will influence future market strategies, emphasizing the need for adaptability and resilience. The decision by Dollar Tree underscores how unpredictable market dynamics can be, even for successful businesses.

The technology sector, faced another setback when the Pentagon canceled a $2.5 billion chip subsidy program intended for Intel, this led to a decrease in Intel’s shares. The end of the chip subsidy program, which was a significant income source for Intel, could alter the technology sector competitively.

Analysts started questioning Intel’s future sustainability without the chip subsidy program. However, Intel reassured stakeholders about its robust business strategy, including diverse revenue streams and continual technological advancements.

The financial landscape was scrutinized by reporters, analysts, and brokers in NYSE to manage the volatile environment. Real-time data and advanced analytics predicted trends and aided decision-making, ensuring stability amidst chaos.

Global markets are anticipating forthcoming producer cost reports and other signs of inflation ahead of the Federal Reserve meeting. Central banks worldwide are under pressure to outline strategies to counteract negative effects if data reveal an uptick in inflation.

Changes in economic stability might trigger effects across global sectors, adding to the current volatility. The need for maintaining market functionalities and stability during these uncertain times is essential, requiring player preparedness across sectors.

The collective responsibility is to monitor developments, adjust strategies where needed, and navigate through economic challenges. All eyes are on the much-anticipated reports worldwide, all hoping for reassuring news.

Information for this article was provided by Caroline Valetkevitch, with supportive data gathered by Bansari Mayur Kamdar and Johann M Cherian from Bengaluru. Pooja Desai and Richard Chang guided the editing process.