The abrupt collapse of the Baltimore bridge on March 30, 2024, sparked widespread panic and traffic pandemonium among locals. With several injuries and a few fatalities recorded, city authorities were swift to cordon off the disaster area and commence investigations.

A statement by the Baltimore city council candidly expressed their shock and assured citizens of the devotion of necessary resources for aid and swift reconstruction. These efforts, however, will not prevent the inevitability of traffic disruptions and alternate route planning for the foreseeable future.

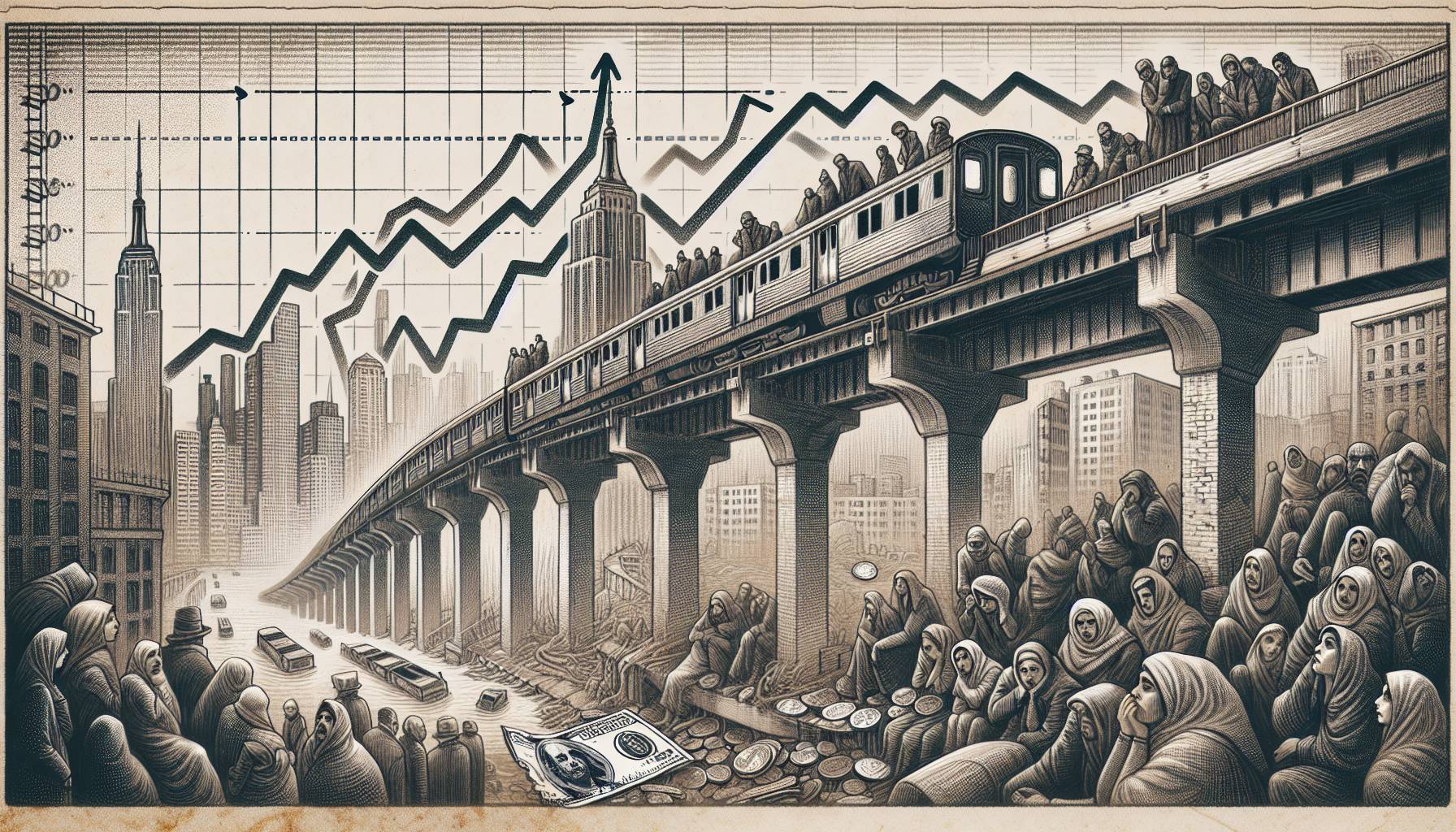

Jonathan Hoenig, a respected hedge fund manager, described the incident as an “unfolding economic tragedy”, prompting considerable backlash and inviting discourse around the issue of the financial crisis caused by the collapse.

Hoenig’s evaluation pointed out that the economic aftermath could potentially outweigh the immediate logistical dilemmas, thereby heralding a period of acute economic unrest. Furthermore, he highlighted that the cascading effects which might intensify the already strained economic situations deserve prompt responses to alleviate consequential financial losses.

The bridge’s cosmic role in local transportation could cause disturbances in the standard flow of goods, thereby heightening costs and inflicting deeper economic distress.

Baltimore bridge collapse: Economic implications

Essential commodities like food, medicine, and raw materials might face scarcity or delay in certain areas, further compounding the financial burdens on locals.

Business operations relying on punctual delivery of goods could also be hard hit, thereby negatively affecting productivity and profitability. These cascading consequences of the bridge collapse underline the fundamental importance of maintaining sturdy and trustworthy transport networks.

Hoenig’s in-depth assessment touched on the wider economic implications of the debacle, notably the indirect effect on businesses relying heavily on the bridge for operations. Such businesses might encounter higher transportation costs, delivery lags, and potential losses in sales, leading to a possible downturn in earnings.

Furthermore, the bridge collapse highlights potential systemic failure due to insufficient maintenance and oversight, serving as a stark reminder of the need for strict infrastructural checks and balances. Continuing debates address the timeline for recovery, long-term impacts on dependent industries, and discuss strategic plans for mitigating business losses during this period.