As the crucial holiday shopping period draws near and the Federal Reserve considers pausing interest rate increases, warning signs are starting to emerge for the U.S. consumer, an essential component of the economy. While consumer spending data has remained strong throughout the year, there are indications that household budgets could be reaching their maximum capacity. Consumer spending is vital, as it accounts for approximately 70% of all U.S. economic activity. As a result, any significant decline in consumer spending could potentially have severe implications for the nation’s economic growth and stability. Analysts are closely monitoring key factors such as income growth, consumer confidence, and savings rates to predict if a spending slowdown is imminent during this crucial shopping season.

Major Retailers Lowering Guidance

Major retailers, including Target and Dick’s Sporting Goods, have recently lowered their guidance, with UBS analyst Jay Sole suggesting that the holiday sales forecast is trending negatively. Sole found that the proportion of consumers planning to spend less during the upcoming holiday season has risen significantly compared to those who plan to spend more. This represents the second-largest gap in 12 years, according to Sole. As a result, retailers may face challenges in generating strong sales growth during the crucial holiday period. This development also raises concerns about the overall health of consumer spending, which has largely been driving the U.S. economy in recent times.

Federal Reserve’s Actions and Goals

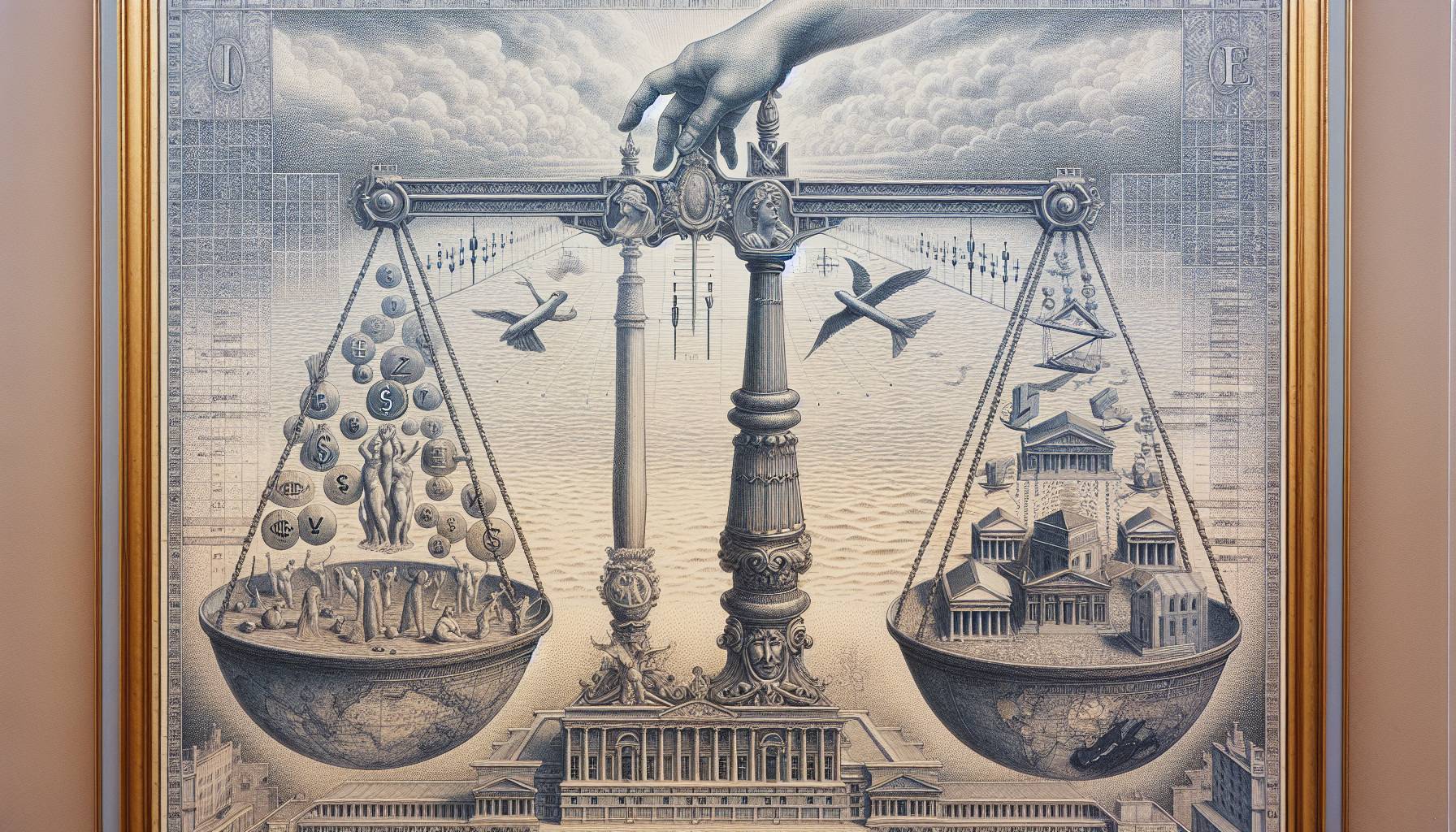

These cautionary signs coincide with the conclusion of the Federal Reserve officials’ September meeting, during which central bankers are widely expected to refrain from a rate hike. The Federal Reserve’s goal is to reduce inflation and stabilize the labor market without triggering a recession, a process known as a “soft landing.” However, maintaining consumer spending is necessary to achieve this. To encourage consumer spending, the Federal Reserve must find a delicate balance between managing inflation and ensuring low interest rates. Striking this balance is crucial, as it not only promotes investment and borrowing but also instills confidence in the market, ultimately fostering economic growth.

Contradictions in Employment and Financial Struggles

Wolfe Research strategist Chris Senyek noted in a message to clients that trends such as a declining quits rate – the percentage of individuals leaving their jobs each month relative to employment – and rising loan delinquencies indicate that consumers are facing difficulties even as wages increase. This contradiction between wage growth and financial struggles reveals an underlying issue in today’s economy, where many individuals are unable to keep up with the rising cost of living despite their income gains. As a result, experts warn that this economic discrepancy could have broader implications on consumer spending, further impacting overall economic growth.

Addressing the Wage Growth Issue

Senyek argues that “cracks are starting to show,” and while wages should continue to grow, numerous consumers feel that recent increases are insufficient and long overdue. Moreover, this perception of inadequate wage growth has led to growing dissatisfaction among the workforce, potentially affecting overall productivity and job satisfaction. As a result, businesses and policymakers need to address these concerns by implementing effective measures that ensure sustainable and equitable income growth for all employees.

Key Takeaways

1. As the holiday shopping season approaches, warning signs of overstrained household budgets emerge, which could impact consumer spending – a vital component of the U.S. economy.

2. Major retailers, such as Target and Dick’s Sporting Goods, are lowering their guidance for the holiday season, indicating potential challenges in generating strong sales during this crucial period.

3. The Federal Reserve’s aim to reduce inflation and stabilize the labor market without triggering a recession requires balancing low interest rates, instilling confidence, and stimulating consumer spending.

4. The contradiction between wage growth and financial struggles highlights an underlying issue in the economy – many are unable to keep up with the rising cost of living despite increased wages, which could impact consumer spending further.

5. Businesses and policymakers must address concerns of inadequate wage growth by implementing measures that promote sustainable and equitable income growth for all employees.

In conclusion, although consumer spending data has remained strong throughout the year, cautionary signs are emerging as we approach the holiday shopping season. Retailers, the Federal Reserve, and policymakers must closely monitor these trends to maintain economic growth and stability within the U.S. economy.

FAQs

What are the signs of a potential slowdown in consumer spending during the holiday season?

Major retailers like Target and Dick’s Sporting Goods have lowered their guidance for the holiday season. Additionally, a rising proportion of consumers plan to spend less during the holidays, making it the second-largest gap in 12 years.

Why is consumer spending important for the U.S. economy?

Consumer spending accounts for approximately 70% of all U.S. economic activity. Any significant decline in consumer spending can have severe implications for the nation’s economic growth and stability.

What is the Federal Reserve’s role in balancing consumer spending and economic growth?

To encourage consumer spending, the Federal Reserve must find a delicate balance between managing inflation and ensuring low interest rates. Striking this balance is crucial, as it promotes investment, borrowing, and instills confidence in the market, ultimately fostering economic growth.

How are wage growth and financial struggles affecting consumer spending?

Despite wage growth, many individuals are unable to keep up with the rising cost of living. This economic discrepancy could impact consumer spending and overall economic growth.

What can businesses and policymakers do to address issues of wage growth?

They need to implement effective measures that ensure sustainable and equitable income growth for all employees. This includes promoting policies and practices that foster fair wage increases to help people cope with the increasing cost of living.

First Reported on: cnbc.com

Featured Image Credit: Photo by Michael Steinberg; Pexels; Thank you!