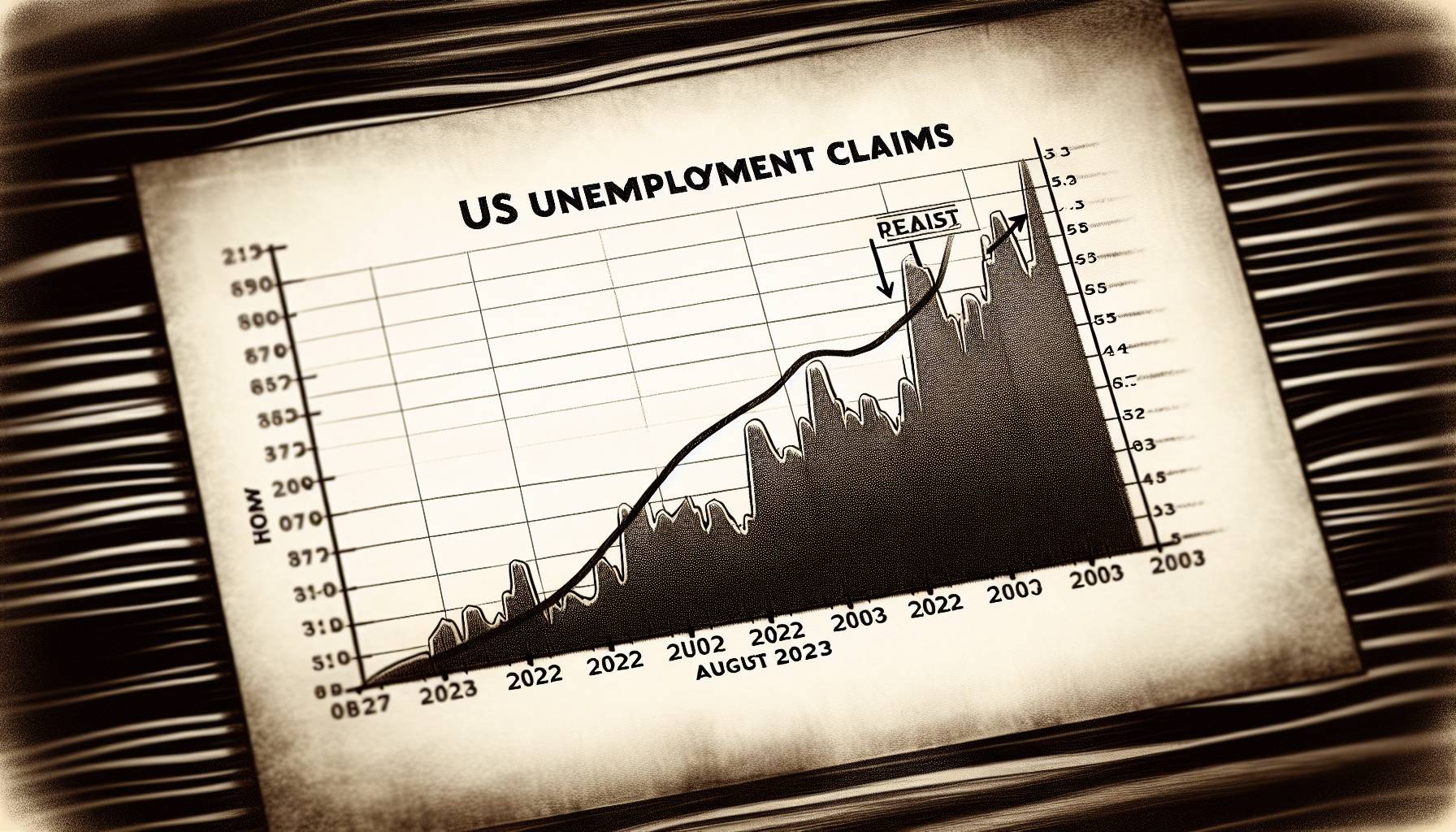

US unemployment claims have escalated to a seasonally adjusted 231,000 during the week ending May 4, reaching the highest level since late August 2023. This symbolizes a rise of 22,000 claims from the previous week.

Majorly hit were job sectors like retail, hospitality, and manufacturing, contributing notably to the surge in unemployment claims. The nationwide unemployment rate rose from 3.9% to 4.0%.

The government is projected to respond with additional funding for job training and placement programs. However, experts propose a broader rethink is required, advocating for enhanced investment in promisingly growing sectors like technology, renewable energy, and healthcare.

American workers are encouraged to exploit existing upskilling and reskilling opportunities. Despite the fading era of job security, adaptability and continuous learning are still crucial for ensuring employment.

The ongoing unemployment claims escalated to 1.78 million, a rise of 17,000 from the prior week, emphasizing the challenging scenario of the job market.

Analysis of recent US unemployment surge

The surge can be viewed as an indication of gradually stagnant recovery rates.

The initial applications for unemployment assistance hit their highest level since August 2023, signifying potential shifts in the labor market. The rise in jobless claims reveals potential vulnerabilities and economic uncertainties.

In April, there was a slowdown in hiring, despite strong employment records from previous months. Christopher Rupkey, the Chief Economist at FWDBONDS, voiced concern over the surge, stating that it poses potential problems for economic stability. He suggests that curtailing the rise in unemployment rates should be a priority for the government to ensure future economic stability.

The current low unemployment rate of 3.9% hampers the Treasury yields. Despite the low unemployment levels, there are still factors, such as high unemployment claims, causing uncertainties and influencing the Treasury yields.